Pet insurance is becoming more commonplace in households all around the world. According to industry data supplied by the North American Pet Health Insurance Association (NAPHIA), the end of 2021 saw an estimated 4.4 million pets insured in North America, reflecting an approximate 28% increase in total insured pets over the year. That’s a large leap since 1982, when the first policy in the United States was written and issued by Veterinary Pet Insurance for the famous television star, Lassie. After four decades of medical and technological advancements and more effective treatments in veterinary care, it’s no wonder so many pet parents see the value in pet insurance. Pet insurance allows you to receive treatment for your pet, file a claim, and get reimbursed for your bills.

How to Choose a Pet Insurance Policy

Many new pet parents think about initial first-time costs like pet adoption, supplies (e.g., beds, crates, litter boxes, and more), spaying and neutering, vaccinations, and initial vet visits, but few anticipate the lifetime cost of pet medical care. The average cost of veterinary claims has risen over the last few years, and with the increase in dog and cat life expectancies, (NAPHIA industry data) now is a great time to insure your pet.

When choosing a policy, understand the needs of your pet. Do a little research and assess any breed-specific issues, age-related issues, or lifestyle-related issues that your pet might develop. Pets that are particularly accident-prone or active might especially benefit from emergency and accident coverage. Wellness plans, on the other hand, are often considered add-ons and can help cover the cost of regular yearly exams and vaccinations.

When shopping around, estimate your projected annual pet-health costs and the actual value of the plan. The policy you choose for your pet will determine what you can be reimbursed for. Here are some important terms to understand as you consider your options:

- Premium: Your premium is what you pay monthly for your policy. Your premium is determined by the total coverage (how comprehensive your plan is) and your pet’s age, species, breed, and location.

- Deductible: This is what you should be able to pay out of pocket before your insurer’s contributions kick in. Take a close look at the deductible when choosing a policy. Let’s say you are filing your first claim: Your deductible is $700 and the cost of your pet’s emergency treatment was $5,000 at a reimbursement rate of 80% ($5,000 – $700 x 0.8 = $3,440). This means that you will receive a reimbursement of $3,440 from your insurer and you will be responsible for the remainder.

- Reimbursement Rate: The reimbursement rate is the percentage of the cost after your deductible is met that you will be reimbursed for. In the above example, the reimbursement rate is 80%, so 80% of the total treatment cost (after the deductible was met) will be reimbursed.

What Pet Insurance Covers?

Most pet insurance companies offer a variety of comprehensive and specialized plans you can customize for your pet’s needs. Depending on the plan you choose, coverage can include many of the following:

- Accidents

- Illnesses

- Cancer treatments

- Hereditary and congenital conditions

- Emergency care and surgery

- Prescriptions/medications

- Diagnostics

- Geriatric care

- Behavioral conditions

- Dental issues

- Prosthetics and wheelchairs

- End-of-life care

- Travel coverage

It’s important to note that pre-existing medical conditions are not covered by insurance providers, which is why insuring your pet as early as possible is key. If your pet does have a pre-existing medical condition that isn’t covered, there may be alternative payment options available, like the CareCredit credit card. CareCredit is a health and pet care credit card that can be used in combination with pet insurance to pay for veterinary out-of-pocket expenses. You may be able to take advantage of flexible financing options that let you pay over time in monthly payments*. A range of financing options are available and you can see if you prequalify for CareCredit with no impact to your credit bureau score at carecredit.com/apply.

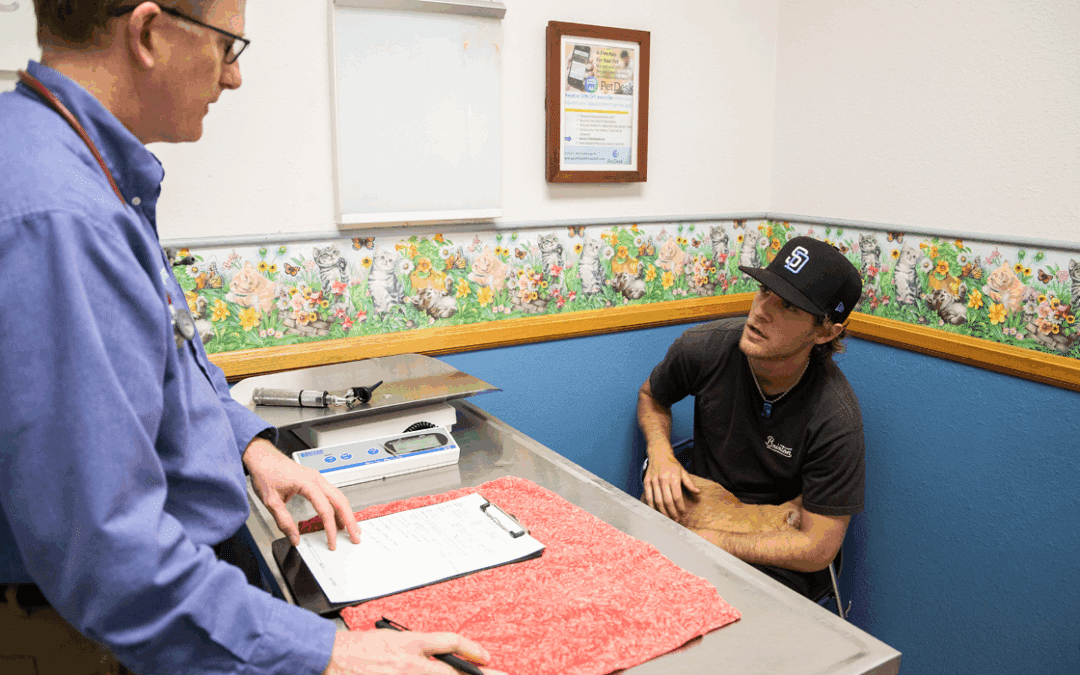

Will I Lose My Current Vet?

No, you will not lose your current veterinarian if you obtain a new pet insurance policy. Pet insurance operates differently from human medical insurance and does not restrict you from continuing with your current veterinarian.

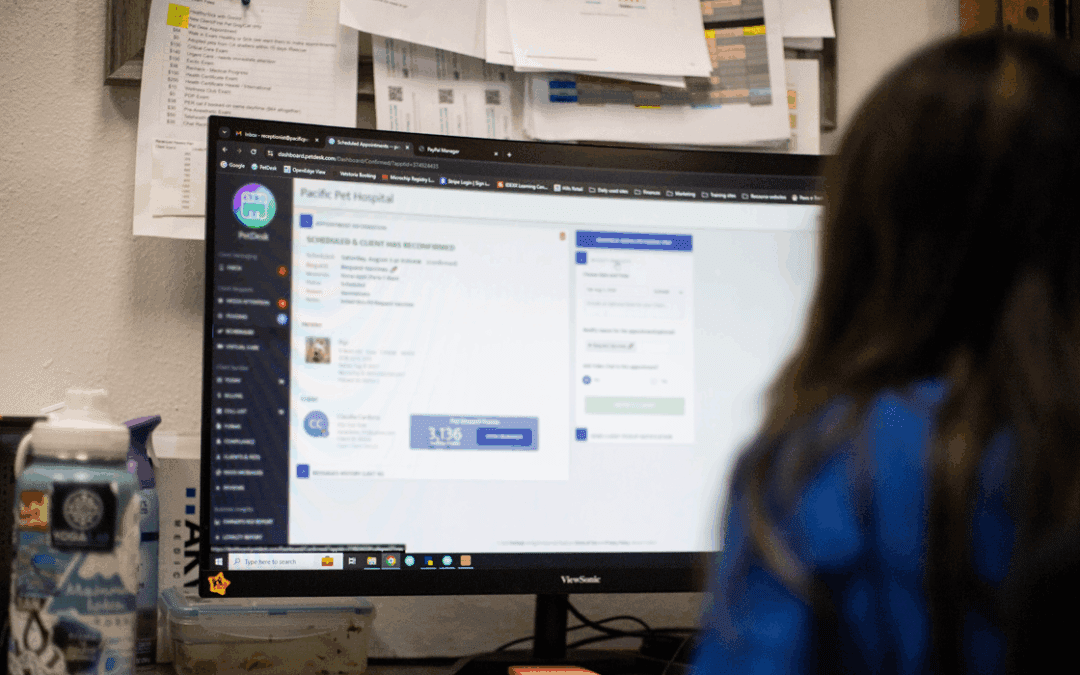

If you’d like to start shopping around for policies today, download the PetDesk mobile app to access free personalized pet insurance options and get a quote in less than 60 seconds.

*Subject to credit approval. See carecredit.com for details.